- Quick Links

- About Us

- Contact Us

- E-Paper

Search

Archives

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

© 2022 Foxiz News Network. Ruby Design Company. All Rights Reserved.

Notification Show More

‘Ensure Foolproof Security, Monitor Social Media Closely’: DGP J&K to Officers

Director General of Police J&K, Nalin Prabhat-IPS chaired a security review meeting at the Conference Hall of Police Control Room Kashmir today, to assess the prevailing security situation in the…

Historic Move: Free homes for families hit by terrorism & natural calamities: LG

Says smart housing is the first step toward long-term rehab in J&K

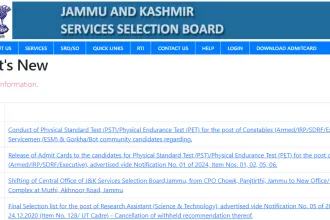

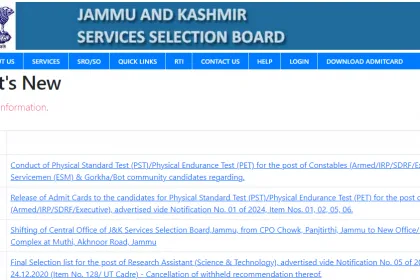

Shifting of Central Office of J&K Services Selection Board

Shifting of Central Office of J&K Services Selection Board,Jammu, from CPO Chowk,…

KPDCL announces power shutdown in Kashmir Parts

According to the Chief Engineer, Distribution, KPDCL, in order to carry out…

Properties of Proclaimed Offenders attached under UAPA in Baramulla

In accordance with the orders passed by the Hon’ble Special Court designated…

Police attach property of notorious drug peddler worth ₹50 lakhs in Budgam

In a major action against drug trafficking, Police on Thursday have attached…

Shifting of Central Office of J&K Services Selection Board

Shifting of Central Office of J&K Services Selection Board,Jammu, from CPO Chowk,…

Admin provides over Rs 1.63 Cr financial assistance to construction workers

Jammu, Sep 10: Deputy Commissioner Jammu Dr. Rakesh Minhas Wednesday…

GCOE hosts awareness seminar to mark suicide prevention day

Jammu, Sep 10: To raise awareness about mental health and…

DC hands over tractor key to HADP beneficiary

Kisthwar, Sep 10: As part of ongoing efforts to empower…

Kashmir doesn’t need a Switzerland comparison: Shark Tank’s Anupam Mittal

Entrepreneur praises Valley’s raw beauty, affordability

Nepal Unrest & India’s Concern

Nepal may have surprised many but it has not surprised those who are watching Nepal from the days of…

Sports

NC welcomes railway parcel vans for apple transportation

Srinagar, Sept 11: National Conference (NC) State Spokesperson, Imran Nabi Dar on…

Weather

20°C

Srinagar

broken clouds

20° _ 20°

74%

1 km/h

Fri

28 °C

Sat

28 °C

Sun

29 °C

Mon

28 °C

Tue

21 °C