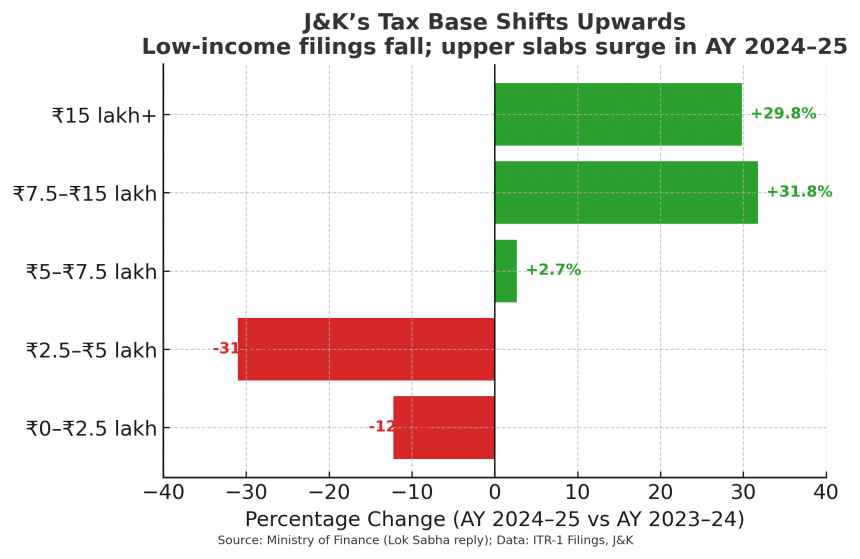

Srinagar, Aug 11: Jammu & Kashmir’s taxpayer count is rising, but the increase is not evenly spread, data reveals. Data accessed by Rising Kashmir shows individual income tax return filings in the Union Territory touched 4,18,495 in Assessment Year 2024–25, up 2.5% from 4,08,366 in the previous year.Beneath this modest rise, however, is a stark divergence: the number of low-income taxpayers has fallen sharply, while higher-income filers have grown at double-digit rates.The steepest decline is in the Rs 2.5–Rs 5 lakh slab, traditionally dominated by salaried employees, pensioners, and small traders, which dropped from 1,97,770 filings last year to just 1,36,402 this year, a fall of over 30%.Returns from those declaring up to Rs 2.5 lakh, effectively below the taxable threshold, slid 12% from 24,828 to 21,792.In contrast, upper slabs have surged. Filings for incomes above Rs 7.5 lakh jumped from 39,907 to 52,589, while those declaring over Rs 15 lakh climbed nearly 30%, from 14,336 to 18,611. Mid-tier slabs between Rs 5 lakh and Rs 7.5 lakh also saw moderate growth.The figures, drawn from ITR-1 returns, the simplest form used largely by salaried individuals and pensioners, paint a picture of an evolving tax profile in J&K, one skewing increasingly towards the higher end.The Union Finance Ministry credits the overall rise in returns to an expansion of taxpayer outreach, citing “Taxpayers’ Hubs” in Tier-2 and Tier-3 towns, targeted campaigns for informal sector workers, and drives to bring first-time filers into the net. It also highlights the role of e-Return Intermediaries (ERIs) — authorised agents and firms who file returns online on behalf of individuals — in widening access.But these services are not free, and experts say cost, along with patchy internet and low digital literacy in rural and remote parts of the UT, may be contributing to the drop in low-income compliance. “While the top of the pyramid is growing, the base is eroding, and that’s where formalisation begins,” said a chartered accountant.The decline at the lower slabs is significant because these filers, though often not paying income tax due to exemptions, represent early entrants into the formal economy. Their presence in the tax net helps widen the base for GST compliance, loan eligibility, and social security enrolment.

In J&K, high-income tax filers surge but low-income returns plunge

Overall filings up 2.5% in AY 2024–25 Rs 2.5–Rs 5 lakh slab sees over 30% drop

Sign Up For Daily Newsletter

Be keep up! Get the latest breaking news delivered straight to your inbox.

By signing up, you agree to our Terms of Use and acknowledge the data practices in our Privacy Policy. You may unsubscribe at any time.

Leave a Comment Leave a Comment

Stay Connected

Latest News

Recent Posts

- Shri Mata Vaishno Devi Shrine Board extends relief to landslide affected families

- Waheed Jeelani congratulates Dr. Darakhshan Andrabi on the historic renovation of Hazratbal Shrine

- Jio surpasses 500 million user base ahead of 9th anniversary, announces series of offers

- LoP Sunil Sharma tours flood hit areas of Jammu, assures immediate relief

- BSF airlifts 47 Civilians from flood-hit village in Akhnoor