Jammu & Kashmir, historically celebrated for its natural beauty and cultural richness, is apparently now poised for a significant economic transformation. For decades, the region’s economy has relied heavily on agriculture, handicrafts, and tourism, which, while valuable, have been insufficient in driving large-scale economic growth and employment. The lack of robust infrastructure, policy stability, and large-scale private investment has further constrained economic growth. However, with post-Article 370 reforms integrating J&K more closely with India’s broader economic framework, the time looks ripe for bold initiatives that can reshape its future.

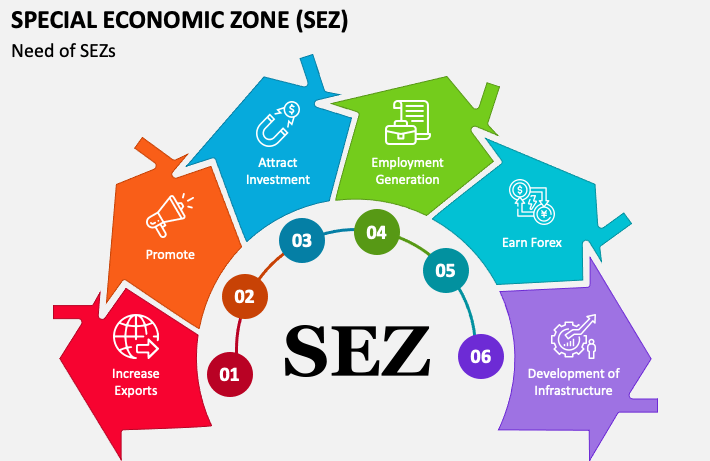

One of the most promising avenues for this transformation is the establishment of Special Economic Zones (SEZs)—designated areas offering preferential tax policies, streamlined regulations, and world-class business infrastructure to attract investment and boost exports. SEZs have been instrumental in driving economic growth in states like Gujarat, Maharashtra, and Tamil Nadu, and globally in countries like China, the UAE, and Singapore. For J&K, with the right policies and infrastructure in place, leveraging its strategic location and unique strengths for long-term sustainable development, SEZs could create thousands of jobs, attract foreign direct investment (FDI), and establish Kashmir as a hub for trade& commerce activities.

Why SEZs are vital for Kashmir?

Kashmir’s economy is currently heavily dependent on tourism and agriculture. SEZs can introduce new industries such as:

- IT & Technology SEZ: Kashmir has a huge IT talent pool but lacks large-scale infrastructure. An IT SEZ (similar to Bengaluru or Hyderabad) in Srinagar or Jammu could attract IT companies, startups, and BPOs. Incentives such as lower power tariffs, 5G-ready zones, and incubation hubs could boost interest.

- Horticulture & Agro-processing SEZ: Kashmir’s apple, saffron, walnut, and almond industries require better processing and export facilities. A dedicated Agro SEZ in Sopore, Shopian, or Pulwama could boost farm exports. Integration with cold storage chains, food processing units, and direct global trade access would be key.

- Handicrafts & Textiles SEZ: Kashmir is globally known for Pashmina, carpets, papier-mâché, and woodwork. Handicrafts SEZ in Srinagar, Anantnag, or Baramulla could provide tax-free exports, R&D hubs, and direct buyer access. Large-scale branding and certification could help position Kashmiri handicrafts as premium global products.

- Renewable Energy SEZ: Kashmir has significant hydropower, solar, and wind energy potential. A Renewable energy SEZ in Ladakh and South Kashmir could attract foreign investments in clean energy. Tax breaks on green investments and priority power purchase agreements could enhance feasibility.

- Pharmaceutical & Biotech SEZ: Kashmir’s clean air and water resources provide ideal conditions for pharma manufacturing. A Pharma SEZ in Jammu or Srinagar could attract biotech and generic drug makers. Integration with AIIMS, SKUAST, and medical research institutions could foster innovation. This shift will reduce economic vulnerability and promote long-term stability.

Employment Generation

One of Kashmir’s major challenges is high unemployment, especially among skilled youth. SEZs can significantly increase employment, with projections indicating:

- 35% rise in industrial jobs

- 20% growth in the service sector

- Enhanced entrepreneurial opportunities through startups and small businesses

Attracting Domestic & Foreign Investments

A key feature of SEZs is their ability to attract investment by offering:

- Tax incentives (e.g., corporate tax holidays).

- Easier land acquisition and lease policies.

- Faster clearance of business approvals.

- Streamlined customs and trade processes.

- Projected investment inflows in SEZs are expected to increase by 30%, bringing capital, expertise, and modern technology to Kashmir.

Infrastructure Development

SEZs necessitate world-class infrastructure, including:

- Modern industrial parks

- Reliable power supply

- Efficient transport networks (roads, railways, air connectivity)

- Digital infrastructure (broadband and IT facilities)

- Kashmir’s SEZ development could boost infrastructure growth by 25%, benefiting both businesses and the local population.

Export Growth & Global Trade Integration

SEZs in Kashmir can strengthen export-driven industries, particularly in:

- Handicrafts and Textiles

- Agricultural Products (Saffron, Apples, Walnuts, Almonds, Honey)

- IT and Software Services

- With customs relaxations and tax-free exports, Kashmir’s global trade presence could increase by 20%, linking it with international supply chains.

Challenges and Legal Considerations for SEZs in Kashmir

The success of SEZs in J&K, however, will depend on strong policy implementation, infrastructure readiness, and investor confidence. Challenges such as land acquisition, security concerns, and bureaucratic inefficiencies must be addressed through transparent governance, public-private partnerships (PPPs), and a region-specific SEZ policy. The government must streamline land leasing policies, establish clear title ownership frameworks, and explore PPP models to acquire land without disputes.

Additionally, inadequate infrastructure, poor road and rail connectivity, and unreliable power and water supply hinder economic growth. To enhance trade and exports, Srinagar and Jammu airports must be upgraded with modern cargo facilities. Investor confidence is also impacted by security concerns and political stability, necessitating investment protection policies, risk insurance mechanisms, and tax holidays to encourage participation from private investors and multinational corporations. A robust SEZ security framework must be implemented to mitigate risks.

Key Lessons from growth and failures SEZ models

Strategic Location & Connectivity: Location plays a crucial role in SEZ success. Noida SEZ benefits from its proximity to Delhi, offering excellent infrastructure and market access. JAFZA thrives due to its integration with Jebel Ali Port, a global trade hub. SEZs in remote or poorly connected areas struggle to attract investment.

Government Incentives & Policy Framework

Favourable policies, including tax exemptions, simplified regulations, and duty-free imports, encourage investment. Noida and JAFZA leveraged these effectively, while inconsistent policies and bureaucratic hurdles in some SEZs, such as Mundra, hampered growth.

Industry-Specific Focus

Specialization helps SEZs scale efficiently. Noida SEZ capitalized on IT and electronics, while JAFZA became a global logistics and re-export hub. SEZs without a clear industrial focus often struggle with underutilized infrastructure and stagnant growth.

Land Acquisition & Community Engagement

SEZ development often faces resistance due to land acquisition issues. Mundra SEZ encountered legal battles and displacement protests, creating long-term challenges. Transparent policies and fair compensation for affected communities are essential for sustainable development.

Infrastructure & Environmental Sustainability

Rapid industrial expansion puts pressure on local infrastructure. Noida SEZ faces congestion, while Mundra SEZ faced environmental concerns. SEZs must ensure parallel investment in roads, utilities, and green initiatives to maintain long-term viability.

Economic Diversification

Over-reliance on a single industry or global trade trends can make SEZs vulnerable. JAFZA’s dependence on international trade poses risks during downturns. Diversifying industries and fostering local business linkages can enhance resilience.

To position Kashmir as an attractive investment destination, the government must host international investor summits, engage in diplomatic outreach with Middle Eastern and European investors, and establish strategic collaborations with Indian MNCs like Tata, Reliance, Infosys, and ITC to encourage their presence in SEZs.

Additionally, Kashmir’s SEZs should be aligned with national programs such as Make in India, Startup India, and the Production-Linked Incentive (PLI) scheme, allowing businesses in the region to access funding, incentives, and global supply chains. A key step toward success would be securing a dedicated SEZ package in the Union Budget, offering fiscal incentives and infrastructure grants specifically for Kashmir. Furthermore, establishing SEZ-focused trade agreements and export promotion policies will enhance competitiveness in global markets.

Key Laws Governing SEZs

- Special Economic Zones Act, 2005 – Provides the foundation for SEZs.

- Special Economic Zones Rules, 2006 – Defines operational guidelines.

- Foreign Trade Policy (FTP) – Offers duty-free import benefits.

- Income Tax Act, 1961 (Section 10AA) – Provides tax exemptions for SEZ businesses.

- Customs Act, 1962 – Facilitates customs clearance for SEZ industries.

Conclusion

SEZs represent a game-changing opportunity for Kashmir. To make Kashmir a successful SEZ destination, the government must streamline economic policies, upgrade infrastructure, boost investor confidence, and introduce a dedicated SEZ framework. Transparent land leasing, improved logistics, investment incentives, and simplified regulations will attract businesses and ensure long-term growth. By integrating sustainability, local employment, and global investor engagement, Kashmir can emerge as a thriving industrial hub, driving economic development and regional prosperity.

(Romaan Muneeb is corporate lawyer at IMR Law Offices, Srinagar, J&K, and Farina Mashoor is a trainee and can be reached at [email protected])