More women are becoming CEOs of big companies, showing major progress since the past. However, women still hold few leadership roles, and this lack of equality continues when it comes to funding businesses run by women. A study shows men launch businesses with nearly double the starting capital of women. On top of that, a mere sliver of small business loan amount goes to women-owned ventures.

So, what’s behind this funding gap for women entrepreneurs? Some might say women are more cautious with risk.

Every business needs cash to operate smoothly. And you shouldn’t let anything stop you from accessing the funding you need. This guide offers effective strategies to tackle funding challenges and get the capital you need to reach your goals.

Challenges for Women’s Financial Inclusion

There are several factors that choke the progress of women’s financial inclusion. Some of them are listed below:

- Confined by Caregiver Roles: The traditional view of women as primary caregivers can restrict their participation in the workforce, limiting the financial products available to them.

- Financial Dependence and Decision-Making: Stereotypes portraying women as less financially adept can lead them to rely on husbands or male relatives for financial decisions and restrict their access to independent accounts. In some regions, like the Middle East and parts of India, legal hurdles may require male guardian approval to open a bank account.

- Barriers to Business Ownership: Societal expectations often discourage women from pursuing entrepreneurship, believing it conflicts with their domestic duties.

- Limited Use of Formal Services: Women might depend heavily on informal financial solutions like self-managed savings groups, money lenders, or loans from family and friends, unlike men who utilise formal financial institutions more frequently. This reliance can hinder access to products like insurance, digital credit, and long-term loans, which are crucial for investments, livelihood improvements, and income diversification.

- Digital Divide and Financial Literacy: Challenges like language barriers on digital platforms, lack of numeracy skills, and the perception of complexity surrounding financial products, particularly among low-income or rural populations, can discourage them from adopting digital financial services like mobile money. This creates an obstacle to accessing these tools for financial empowerment.

Strategies to Overcome Financial Barriers for Women

Women face many challenges regarding money. Societal expectations, trouble using regular banks and financial products, and a lack of financial knowledge can make it hard for them to save money, start businesses, and reach their financial goals. But there are ways to overcome these obstacles!

Breaking Down Barriers:

- Financial Know-How Workshops: Understanding money helps women make good choices with their finances. Workshops and online courses can teach women how to budget, save, and understand different financial products.

- Sharing the Load at Home: Dividing chores at home fairly is important. When housework is shared and work schedules are flexible, women have more time to focus on their careers and businesses.

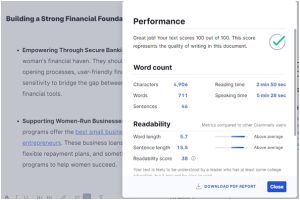

Building a Strong Financial Foundation:

- Empowering Through Secure Banking: Regular banks can be a woman’s financial haven. They should offer streamlined account-opening processes, user-friendly financial products, and cultural sensitivity to bridge the gap between women and mainstream financial tools.

- Supporting Women-Run Businesses: Many banks and government programs offer the best small business loans for women These business loans often have good interest rates, flexible repayment plans, and sometimes even mentorship programs to help women succeed.

- Getting Started Without Putting Up Assets: Regular loans often require collateral, which may be a problem for women who may not have a lot of extra stuff. NBFCs, microfinance institutions and community development groups can offer collateral-free business loans, making it easier for women to get the money they need to get their businesses off the ground.

Conclusion

Money shouldn’t hold women entrepreneurs back! By learning about finances, exploring different funding options besides banks, and finding a support network, women can break through funding barriers and turn their ideas into successful businesses.

NBFCs can be a big help for women entrepreneurs. They offer loans designed specifically for women-owned businesses and make the application process easier. With NBFCs on their side, women can bridge the funding gap and build a brighter future for everyone. Remember, hard work, determination, and the right financial resources can help women entrepreneurs achieve their dreams.

Grammarly Reports

AI Content Report